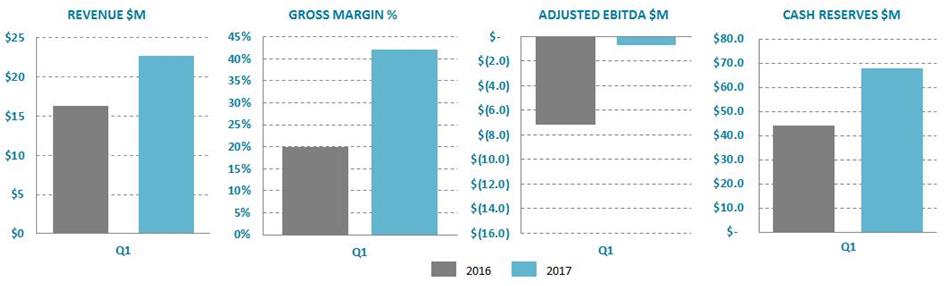

- 39% revenue growth and solid gross margin represent strong year-on-year improvements

VANCOUVER, CANADA – Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) today announced consolidated financial results for the first quarter ended March 31, 2017. All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (IFRS).

“We made continued progress in Q1 on strategic positioning and improved financial performance,” said Randy MacEwen, President and CEO. “Our strategic focus on high growth and high gross margin market opportunities translated to 39% revenue growth and gross margin performance of 42%. With our performance in Q1, coupled with a record order book and sales pipeline for 2017 delivery, we see a strong set-up for the remainder of 2017.”

Mr. MacEwen continued, “Since the start of the year, we have made important progress in the execution of our China strategy. We closed a technology transfer transaction having an estimated value of $25 million with our strategic partner Broad-Ocean, enabling Broad-Ocean to manufacture Ballard-designed modules in three regions in China. We also signed an $11 million equipment supply agreement with Broad-Ocean for 200 fuel cell modules. In addition, we established a relationship with Yinlong, a major Chinese bus OEM, including the sale of initial modules for integration into buses that are expected to be deployed in Beijing.”

Mr. MacEwen concluded, “The strategic positioning and expected scaling of our business supports our planned growth trajectory and advancement toward sustainable profitability.”

Q1 2017 Financial Highlights

(all comparisons are to Q1 2016 unless otherwise noted)

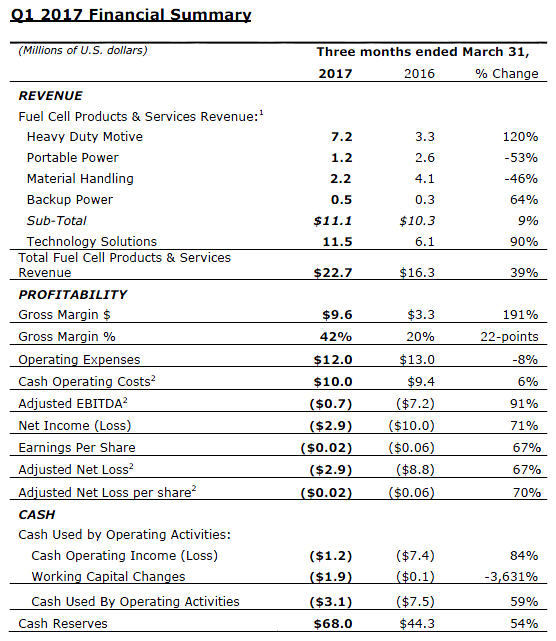

- Total revenue was $22.7 million in the quarter, an increase of 39% resulting from growth in both Power Products and Technology Solutions.

- The Power Products platform generated revenue of $11.1 million in the quarter, an increase of 9%:

- Heavy Duty Motive revenue was $7.2 million, an increase of 120% resulting from shipments of power modules and fuel cell stacks to fulfill orders in support of clean energy vehicles in China;

- Revenue from the Portable Power market was $1.2 million, a decline of 53% due to lower Power Manager product shipments to military customers, as Q1 2016 had benefited from product shipments relating to an order placed by the U.S. Army late in the prior year;

- Material Handling revenue was $2.2 million, a decline of 46% primarily resulting from lower fuel cell stack shipments to Plug Power combined with a lower average selling price due to product mix; and

- Backup Power revenue was $0.5 million, an increase of $0.2 million resulting primarily from product shipments to Asia Pacific.

- The Technology Solutions platform generated revenue of $11.5 million in the quarter, an increase of 90% reflecting work on bus and tram programs in China.

- Gross margin was 42% in Q1, an improvement of 22-points primarily due to a shift in product mix toward higher margin Technology Solutions and Heavy Duty Motive for the China market, including the ongoing establishment of a production line in Yunfu, China for the manufacture and assembly of FCvelocity®-9SSL fuel cell stacks.

- Cash operating costs2 were $10.0 million in the quarter, a 6% increase attributable to higher research and product development expenditures as well as a stronger Canadian dollar relative to the U.S. dollar, since a significant amount of cost is denominated in Canadian dollars.

- Adjusted EBITDA2 was ($0.7) million in Q1, an improvement of $6.6 million or 91%.

- Net income was ($2.9) million in the quarter, an improvement of $7.1 million or 71%.

- Adjusted net income2 was ($2.9) million, an improvement of $5.9 million or 67%.

- Adjusted net loss per share2 was ($0.02) per share, an improvement of 70%.

- Cash used by operating activities was ($3.1) million, an improvement of 59% reflecting cash operating loss of ($1.2) million and use in working capital of ($1.9) million.

- Cash reserves were $68.0 million at March 31, 2017, an increase of 54% from the end of Q1 2016.

Q1 2017 Sales and Operations Highlights

- Signed a definitive agreement with Zhongshan Broad-Ocean Motor Co., Ltd. (“Broad-Ocean”) relating to technology transfer, licensing and supply arrangements for the assembly and sale of FCveloCity® 30-kilowatt (kW) and 85kW fuel cell engines in three strategic regions of China, including Shanghai. The deal has an estimated value of approximately $25 million in revenue to Ballard over the initial 5-year term, including Technology Solutions revenue of $12 million. The transaction was subsequently closed on April 6th, at which time Ballard received initial payments totaling $3.6 million.

- Subsequent to the quarter, on April 5th, announced a definitive equipment supply agreement with Broad-Ocean for the supply and delivery of 200 FCveloCity® fuel cell engines to be used in demonstrations of clean energy buses and commercial vehicles in key Chinese cities, with the engines manufactured and supplied by Ballard from its operations in British Columbia. The deal value is approximately $11 million, which is incremental to the expected $25 million value of the technology transfer deal that closed April 6th.

- Signed an initial equipment sales agreement with Zhuhai Yinlong Energy Group, a major Chinese manufacturer of battery electric buses, for 10 FCveloCity® 30kW fuel cell engines, which Ballard plans to deliver in 2017 for integration into buses to be deployed in Beijing.

- Joined the Fuel Cell Electric Bus Commercialization Consortium, a large-scale project for which funding has now been committed to support deployment of 20 zero-emission fuel cell electric buses at two California transit agencies. Ten (10) buses are to be deployed with Alameda Contra-Costa Transit District (AC Transit) and 10 buses are to be deployed with the Orange County Transportation Authority (OCTA).

- Protonex, Ballard’s Portable Power subsidiary, received certification from the U.S. Government enabling its SPM-622 Squad Power Manager and VPM-402 Vest Power Manager products to be exported under the Commerce Department’s Export Administration Regulations, classification EAR99. With this classification, these products can be sold to allied military partners as well as commercial customers without the need for an export license.

Q1 2017 Corporate Platform Highlights

- Opened the first Ballard corporate office in China headquartered in Guangzhou, to serve as an initial operations center supporting management, sales and business development, technical, after-sales and administration activities. Ballard plans to expand its China team to almost 20 people by year-end 2017.

- Purchased all shares in Ballard’s European subsidiary held by Dansk Industri Invest A/S (previously Dantherm Air Handling A/S) for a nominal value and, as a result, Ballard now owns 100% of the Company’s subsidiary in Europe, ‘Ballard Power Systems Europe A/S’.

- Subsequent to the quarter announced that Mr. Rob Campbell had joined Ballard as Vice President and Chief Commercial Officer.

For a more detailed discussion of Ballard Power Systems’ first quarter 2017 results, please see the company’s financial statements and management’s discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Conference Call

Ballard will hold a conference call on Tuesday, May 2, 2017 at 8:00 a.m. PDT (11:00 a.m. EDT) to review its first quarter 2017 operating results. The live call can be accessed by dialing +1.604.638.5340. Alternatively, a live audio and slide webcast can be accessed through a link on Ballard’s homepage (www.ballard.com). Following the call, the audio webcast and presentation materials will be archived in the ‘Investor Presentations and Events’ area of the ‘Investors’ section of Ballard’s website (www.ballard.com/investors).

About Ballard Power Systems

Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) provides clean energy products that reduce customer costs and risks, and helps customers solve difficult technical and business challenges in their fuel cell programs. To learn more about Ballard, please visit www.ballard.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements concerning projected revenue growth, product shipments, gross margin, Adjusted EBITDA, cash operating expenses and product sales. These forward-looking statements reflect Ballard’s current expectations as contemplated under section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any such statements are based on Ballard’s assumptions relating to its financial forecasts and expectations regarding its product development efforts, manufacturing capacity, and market demand. For a detailed discussion of the factors and assumptions that these statements are based upon, and factors that could cause our actual results or outcomes to differ materially, please refer to Ballard’s most recent management discussion & analysis. Other risks and uncertainties that may cause Ballard’s actual results to be materially different include general economic and regulatory changes, detrimental reliance on third parties, successfully achieving our business plans and achieving and sustaining profitability. For a detailed discussion of these and other risk factors that could affect Ballard’s future performance, please refer to Ballard’s most recent Annual Information Form. These forward-looking statements are provided to enable external stakeholders to understand Ballard’s expectations as at the date of this release and may not be appropriate for other purposes. Readers should not place undue reliance on these statements and Ballard assumes no obligation to update or release any revisions to them, other than as required under applicable legislation.

Further Information: Guy McAree +1.604.412.7919, media@ballard.com or investors@ballard.com

1 We report our results in the single operating segment of Fuel Cell Products and Services. Our Fuel Cell Products and Services segment consists of the sale and service of fuel cell products for our power product markets of Heavy Duty Motive (consisting of bus and tram applications), Portable Power, Material Handling and Backup Power, as well as the delivery of Technology Solutions, including engineering services, technology transfer and the license and sale of our extensive intellectual property portfolio and fundamental knowledge for a variety of fuel cell applications.

2 Note that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss), are non GAAP measures. Non GAAP measures do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Ballard believes that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) assist investors in assessing Ballard’s operating performance. These measures should be used in addition to, and not as a substitute for, net income (loss), cash flows and other measures of financial performance and liquidity reported in accordance with GAAP. For a reconciliation of Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) to the Consolidated Financial Statements, please refer to Ballard’s Management’s Discussion & Analysis.

Cash Operating Costs measures operating expenses excluding stock based compensation expense, depreciation and amortization, impairment losses or recoveries on trade receivables, restructuring charges, acquisition costs and financing charges. EBITDA measures net loss attributable to Ballard Power Systems Inc. excluding finance expense, income taxes, depreciation of property, plant and equipment, amortization of intangible assets, and goodwill impairment charges. Adjusted EBITDA adjusts EBITDA for stock based compensation expense, transactional gains and losses, asset impairment charges, finance and other income, and acquisition costs. Adjusted Net Income (Loss) measures net income (loss) attributable to Ballard from continuing operations, excluding transactional gains and losses, asset impairment charges, and acquisition costs.