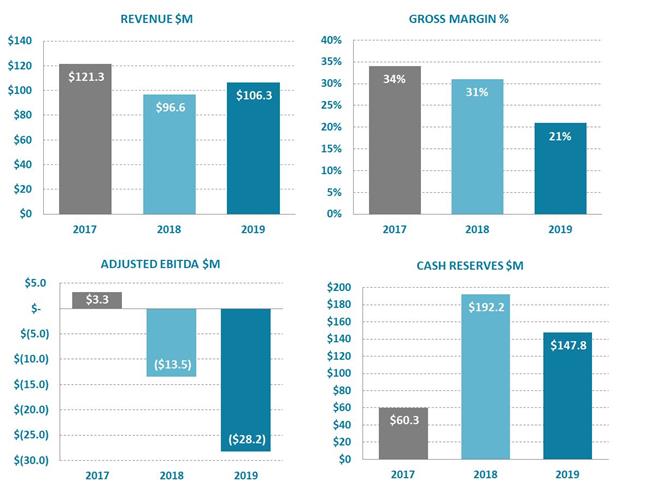

• $106.3M full year revenue exceeds 2019 outlook

• $147.8M cash reserves at year-end

• 2020 outlook for revenue of approximately $130 million, supported by 12-month order book of $110.3M at year-end 2019

VANCOUVER, CANADA – Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) today announced consolidated financial results for the fourth quarter and full year ended December 31, 2019. All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (IFRS).

Randy MacEwen, President and CEO said, “We closed out 2019 with high activity levels, record quarterly revenue of $41.9 million in Q4, and full year revenue of $106.3 million, exceeding our full year outlook. Gross margin for the full year was 21%, Adjusted EBITDA was ($28.2) million and year-end cash reserves were $147.8 million. In 2019 Ballard also delivered continued progress in the execution of our strategy: we launched our next-generation LCS fuel cell stack and FCmoveTM power module, offering lower cost and enhanced performance; we received purchase orders for fuel cell products from the Weichai-Ballard joint venture in China, with construction of the joint venture facility moving toward commissioning by mid-year 2020; we announced our membership in the H2Bus Consortium in Europe as well as the creation of a Marine Center of Excellence at our Denmark facility.”

Mr. MacEwen continued, “In 2019 the hydrogen and fuel cell industry experienced remarkable momentum. A total of 18 countries, representing 70% of global GDP, announced hydrogen and fuel cell roadmaps. Major mobility players, including Weichai, Bosch, Cummins, Faurecia, Michelin, CNH, Hyundai and others, committed to significant investments in fuel cells. There is growing consensus in the financial community regarding a reallocation of capital as a direct result of global climate change. And, deployments of fuel cell electric buses and trucks also increased significantly in 2019, led by China.”

Mr. MacEwen added, “I believe there is now a consolidated industry view that the most attractive near-term markets for fuel cell electric vehicles, or FCEVs, are in Medium- and Heavy-Duty Motive use cases that feature heavy payload, long daily range and a need for fast refuelling. Two important studies released in January 2020 underscore the expectation that FCEVs will be the most competitive zero-emission option from a total-cost-of-ownership perspective for numerous medium and heavy vehicle use cases, as well as the most environmentally attractive: a Hydrogen Council report, prepared in conjunction with McKinsey, entitled “Path to Hydrogen Competitiveness: A cost perspective”; and a white paper prepared jointly by Deloitte China and Ballard entitled “Fueling the Future of Mobility: Hydrogen and fuel cell solutions for transportation”.”

Mr. MacEwen concluded, “Looking ahead to 2020, we anticipate total revenue of approximately $130 million as we address Medium- and Heavy-Duty Motive demand in key global markets. Ballard will continue to invest in world-leading technology and product development, including product cost reduction, while also completing our planned expansion in MEA production capacity at Ballard’s Vancouver facility. We will also invest in our Weichai-Ballard joint venture in China, as this facility transitions from construction to operation. In 2020, we will deepen our exposure to the European market as signals further strengthen to decarbonize mobility with hydrogen fuel cell solutions. We anticipate significant longer-term growth in China, Europe and California, setting the stage for attractive returns for Ballard and our shareholders.”

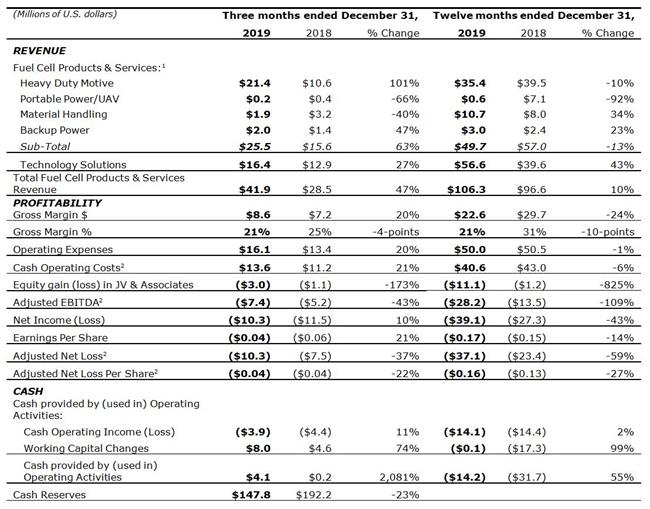

Q4 2019 Financial Highlights

(all comparisons are to Q4 2018 unless otherwise noted)

- Total revenue was $41.9 million, a 47% year-over-year increase and a record quarter.

- Power Products revenue was $25.5 million, an increase of 63% reflecting increases in the shipment of products for Heavy Duty Motive applications, as well as an increase in Backup Power product shipments, partially offset by decreases in Material Handling and Portable Power/UAV.

- Technology Solutions revenue was $16.4 million, a 27% increase due primarily to the Weichai-Ballard joint venture (JV) technology transfer program.

- Gross margin was 21%, down 4-points to $8.6 million, due primarily to a shift in revenue and product mix.

- Cash operating costs2 were $13.6 million, an increase of 21%, due primarily to higher program development and engineering expenses incurred by Ballard Power Systems Europe A/S to support marine market applications.

- Adjusted EBITDA2 declined 43% to ($7.4) million, due primarily to higher equity in loss of investment in joint ventures and associates.

- Net loss3 was ($10.3) million or ($0.04) per share, improvements of 10% and 21%, respectively, driven primarily by the decrease in loss on sale of assets and by higher finance and other income. Net loss in the fourth quarter of 2018 also included a loss on sale of assets of ($4.0) million, related to the divestiture of Power Manager.

- Adjusted net loss2 was ($10.3) million or ($0.04) per share, declines of 37% and 22%, respectively.

- Cash provided by operating activities was $4.1 million, an improvement of 2,081%, reflecting cash operating loss of ($3.9) million, more than offset by net working capital changes of $8.0 million largely related to lower inventory to satisfy Q4 shipments.

Full Year 2019 Financial Highlights

(all comparisons are to full year 2018 unless otherwise noted)

- Total revenue was $106.3 million, a 10% year-over-year increase.

- Power Products revenue was $49.7 million, down 13% due primarily to lower MEA shipments to Guangdong Synergy Ballard Hydrogen Power Co., Ltd. (“Synergy JVCo”), partially offset by increased shipments of a variety of fuel cell products primarily to customers in China and Europe.

- Technology Solutions revenue was $56.6 million, an increase of 43% due primarily to the Weichai-Ballard JV technology transfer program.

- Gross margin was 21%, down 10-points to $22.6 million, due primarily to a shift in revenue and product mix, including lower shipments of MEAs to Synergy JVCo and lower Portable Power/UAV revenues resulting from the disposition of Power Manager assets in Q4 2018.

- Cash operating costs2 were $40.6 million, a decrease of 6% due primarily to lower expenses as a result of the disposition of Power Manager assets and associated personnel reduction in Q4 2018.

- Adjusted EBITDA2 declined to ($28.2) million, due primarily to higher equity in loss of investment in joint venture and associates attributed to the ongoing establishment of Weichai-Ballard JV operations.

- Net loss3 increased to ($39.1) million or ($0.17) per share, declines of 43% and 14%, respectively. The increase in net loss was driven primarily by the increase in Adjusted EBITDA loss including higher equity in loss of investment in joint venture and associates.

- Adjusted net loss2 was ($37.1) million or ($0.16) per share, declines of 59% and 27%, respectively.

- Cash used in operating activities was ($14.2) million, an improvement of 55% reflecting cash operating loss of ($14.1) million and net working capital changes of ($0.1) million.

- Cash reserves were $147.8 million at December 31, $44.4 million lower than at the end of 2018.

- The Order Backlog at end-2019 was $178.7 million, down from $199.6 million at end-Q3, reflecting $41.9 million in shipments and $21.0 million in new orders in Q4. At end-2019 the 12-month Order Book was $110.3 million, a decrease of $13.3 million from end-Q3, and an increase of $41.3 million from $69.0 million at end-2018.

2020 Outlook

Ballard intends to maintain focus throughout 2020 on Heavy- and Medium-Duty Motive applications – including bus, commercial truck, train and marine segments – to increase penetration in the key markets of China, Europe and California. We will continue to invest in next-generation products and technology, including MEAs, stacks, modules, and system integration, as well as advanced manufacturing processes, technologies and equipment. We will also continue to invest in technology and product cost reduction and in production capacity expansion.

At the present time the Company’s 2020 outlook does not reflect any material impact of the coronavirus disease (COVID-19). It is currently too early to accurately project any impact, since the duration and scope of the outbreak is not yet known with any certainty. If the outbreak continues for an extended period of time, Ballard and the Weichai-Ballard JV may experience supply chain disruptions, a decline in sales activities, and reductions in operations and workforce.

Consistent with the Company’s practice, and in view of the early stage of hydrogen fuel cell market development and adoption, Ballard is not providing specific financial performance guidance for 2020. However, directionally the Company anticipates total revenue of approximately $130 million in 2020. This growth is expected to primarily result from commercial progress in the Heavy-Duty Motive segment, underpinned by increasing demand for FCEVs in China and Europe. Ballard’s 12-month Order Book of $110.3 million at the end of 2019, together with a robust sales pipeline, establishes a strong foundation for our projected full year 2020 revenue outlook.

In China, the Company continues to expect the Weichai-Ballard JV facility to be commissioned and operating by mid-year 2020. Ballard anticipates delivery of membrane electrode assemblies to the Weichai-Ballard JV for the production of next-generation LCS fuel cell stacks and FCmoveTM fuel cell modules. During 2020 the Company has a commitment to make contributions totaling approximately $20 million towards its pro rata ownership share of the Weichai-Ballard JV. This is in addition to $20.9 million contributed in 2019 and $14.6 million contributed in 2018, as part of Ballard’s total capital commitment of approximately $78 million. The Company also expects to report equity losses of approximately $10-15 million in connection with the Weichai-Ballard JV in 2020.

In Europe, during 2020 Ballard plans to continue execution of its automotive program with Audi, and to deliver a significant number of modules to support deployments of Fuel Cell Electric Buses (FCEBs) in a number of countries. The Company also expects increased market activity for FCEBs, which can be expected to result in additional module purchase orders.

Within North America in 2020, Ballard expects continued market activity in California for FCEBs and fuel cell-powered trucks, which can be expected to result in additional module purchase orders. In addition, the Company expects a volume contraction of fuel cell stack sales for material handling applications.

Technology Solutions revenue is expected to be relatively flat in 2020, compared to 2019, primarily reflecting ongoing work on our technology transfer programs with Audi and Weichai-Ballard JV. In addition to the Audi and Weichai-Ballard JV programs, Technology Solutions engineering services activity is expected with existing and new customers in a variety of markets.

Ballard intends to establish an At-The-Market equity program (“ATM Program”) and to issue up to $75 million of common shares from treasury to the public from time to time at the Company’s discretion, subject to favorable market conditions. The ATM Program will be conducted under the Company’s existing $150 million Base Shelf Prospectus and will be used to fund growth and strategic opportunities.

Q4 & Full Year 2019 Financial Summary

For a more detailed discussion of Ballard Power Systems Q4 and full year 2019 results, please see the Company’s financial statements and management’s discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Conference Call

Ballard will hold a conference call on Thursday, March 5, 2020 at 8:00 a.m. PT (11:00 a.m. ET) to review Q4 and full year 2019 operating results and Outlook for 2020. The live call can be accessed by dialing +1.604.638.5340. Alternatively, a live audio and PowerPoint slide webcast can be accessed through a link on Ballard’s homepage (www.ballard.com). Following the call, the audio webcast will be archived in the ‘Earnings, Interviews and Presentations’ area of the ‘Investors’ section of Ballard’s website (www.ballard.com/investors).

About Ballard Power Systems

Ballard Power Systems’ (NASDAQ: BLDP; TSX: BLDP) vision is to deliver fuel cell power for a sustainable planet. Ballard zero-emission PEM fuel cells are enabling electrification of mobility, including buses, commercial trucks, trains, marine vessels, passenger cars, forklift trucks and UAVs. To learn more about Ballard, please visit www.ballard.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements concerning projected revenue growth, product shipments, gross margin, Adjusted EBITDA, cash operating expenses product sales and market adoption of fuel cell electric vehicles. These forward-looking statements reflect Ballard’s current expectations as contemplated under section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any such statements are based on Ballard’s assumptions relating to its financial forecasts and expectations regarding its product development efforts, manufacturing capacity, and market demand. For a detailed discussion of the factors and assumptions that these statements are based upon, and factors that could cause our actual results or outcomes to differ materially, please refer to Ballard’s most recent management discussion & analysis. Other risks and uncertainties that may cause Ballard’s actual results to be materially different include general economic and regulatory changes, detrimental reliance on third parties, successfully achieving our business plans and achieving and sustaining profitability. For a detailed discussion of these and other risk factors that could affect Ballard’s future performance, please refer to Ballard’s most recent Annual Information Form. These forward-looking statements are provided to enable external stakeholders to understand Ballard’s expectations as at the date of this release and may not be appropriate for other purposes. Readers should not place undue reliance on these statements and Ballard assumes no obligation to update or release any revisions to them, other than as required under applicable legislation.

Further Information

Guy McAree +1.604.412.7919, investors@ballard.com or media@ballard.com

Endnotes:

1 We report our results in the single operating segment of Fuel Cell Products and Services. Our Fuel Cell Products and Services segment consists of the sale and service of PEM fuel cell products for our power product markets of Heavy Duty Motive (consisting of bus, truck, rail and marine applications), Portable Power/UAV, Material Handling and Backup Power, as well as the delivery of Technology Solutions, including engineering services, technology transfer and the license and sale of our extensive intellectual property portfolio and fundamental knowledge for a variety of fuel cell applications.

2 Note that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss), are non GAAP measures. Non GAAP measures do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Ballard believes that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) assist investors in assessing Ballard’s operating performance. These measures should be used in addition to, and not as a substitute for, operating expenses, net income (loss), cash flows and other measures of financial performance and liquidity reported in accordance with GAAP. For a reconciliation of Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) to the Consolidated Financial Statements, please refer to Ballard’s Management’s Discussion & Analysis.

Cash Operating Costs measures operating expenses excluding stock based compensation expense, depreciation and amortization, impairment losses or recoveries on trade receivables, restructuring charges, acquisition costs, the impact of unrealized gains or losses on foreign exchange contracts, and financing charges. EBITDA measures net loss excluding finance expense, income taxes, depreciation of property, plant and equipment, and amortization of intangible assets. Adjusted EBITDA adjusts EBITDA for stock based compensation expense, transactional gains and losses, asset impairment charges, finance and other income, the impact of unrealized gains or losses on foreign exchange contracts, and acquisition costs. Adjusted Net Income (Loss) measures net income (loss) excluding transactional gains and losses, asset impairment charges, and acquisition costs.